Federal Student Aid

For information, please contact Tamara Stokes, Financial Administrator, at 215-592-7910 or financialaid@studioincamminati.org

Watch the video: Types of Federal Student Aid

Federal Pell Grant

The Pell Grant is a need-based award that does not have to be repaid. Pell Grants are awarded only to undergraduate students who have not earned a bachelor’s degree. Award amounts and eligibility are determined by a standard calculation (established by the U.S. Congress) based on a student’s Free Application for Federal Student Aid (FAFSA). The calculation also produces a student’s Expected Family Contribution (EFC). The Student Aid Report (SAR) tells students their EFC and eligibility to receive a Pell grant. The Financial Aid Administrator determines the actual award amount based on a student’s cost of education, enrollment status, and EFC. The maximum Federal Pell Grant for a full-time undergraduate student is $6,195 for 2019-2020. A student may receive a maximum of six years of Pell grants.

Iraq and Afghanistan Service Grant

The Iraq and Afghanistan Service Grant is an award for students who are not eligible for Pell Grant on the basis of EFC, but meet the other Pell Grant eligibility requirements and the student’s parent or guardian was a member of the U.S. armed forces and died as a result of service performed in Iraq or Afghanistan after Sept. 11, 2001. To receive the grant, the student must be under 24 years old or enrolled in college, at least part-time, at the time of the parent’s or guardian’s death. The amount of the grant will be equal to the maximum Pell Grant for the award year, although the amount will not exceed the cost of attendance for the year.

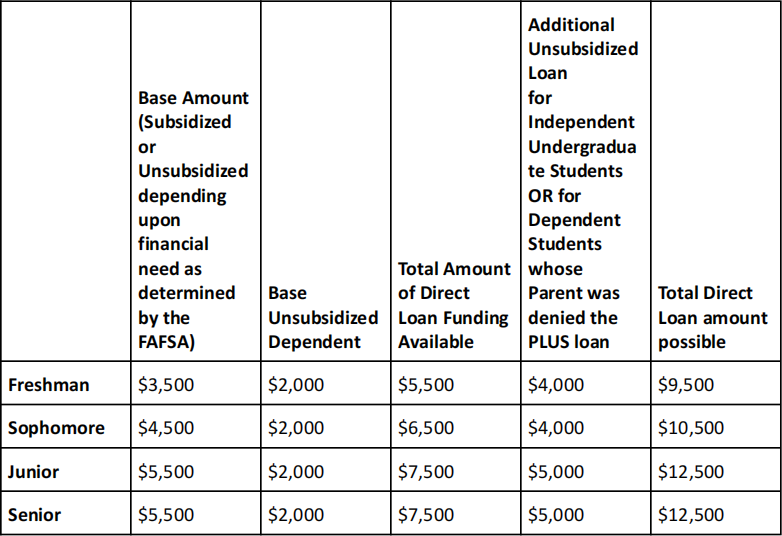

Federal Subsidized Direct Loan (formerly Federal Subsidized Stafford Loan)

The Federal Subsidized Direct Loan is a fixed rate loan for undergraduate students, if eligible. Undergraduate students may borrow up to $3,500 for the first year, $4,500 for the second year, and $5,500 for two additional years, and if needed, an additional $4,000 for the fifth year for an aggregate undergraduate maximum of $23,000. The loan funds will be electronically transferred to the student’s account after completing Entrance Counseling and a valid loan application (Master Promissory Note – MPN) and MPN is certified by the Financial Aid Administrator.

No interest will accrue on the Federal Subsidized Direct Loans and no payments are required of the principal during the entire in-school period, provided that students maintain at least half-time status per semester. The loan also provides a grace period of 6 months after graduation or ceased to be enrolled at half-time status before repayment of principal and interest is due. The repayment period for the Federal Subsidized Direct Loan is 10 years.

A loan fee of 1.059% will be deducted from the gross loan amount prior to each disbursement of both Subsidized and Unsubsidized loans.

Interest Rates for Subsidized Direct Loan:

2019-20 Academic Year (Loans disbursed after July 1, 2019) 4.53%

Federal Unsubsidized Direct Loan (formerly Federal Unsubsidized Stafford Loan)

The Federal Unsubsidized Direct Loan is a fixed-rate loan for undergraduate students. If students do not qualify for a Federal Subsidized Direct Loan, a Federal Unsubsidized Direct Loan at 6.08% can be issued for the full amount of eligibility or in combination with the Federal Subsidized Direct Loan. Interest may be paid quarterly while in school or capitalized (added to principal each year). Repayment of principal starts six months after students leaves school and has ten years to repay the loan.

Dependent students whose parents apply and are rejected for a Federal Direct Parent PLUS Loan may be eligible for additional unsubsidized Direct Loan funding. Freshmen and sophomores may receive an additional $4,000 each year and juniors and seniors may receive an additional $5,000 each year. For independent students, the additional unsubsidized loan amounts will automatically be calculated for based on grade level and will be included as part of your financial aid award(s).

A loan fee of 1.066% will be deducted from the gross loan amount prior to each disbursement of both Subsidized and Unsubsidized loans.

Direct Loan Chart

Federal Direct Parent PLUS Loan

For dependent students, the Federal Direct Parent PLUS Loan allows parents to borrow money for education. The PLUS Loan has a fixed rate of 7.08%. A 4.236% fee is deducted from the loan from each disbursement. The maximum amount parents can borrow is the cost of education minus any other financial aid received. Eligibility for the Federal Direct Parent PLUS Loan is determined by a credit check. To apply for the Parent PLUS Loan, please go to www.studentloans.gov.

If a parent is rejected for a PLUS Loan due to adverse credit history, they may be eligible for additional funds under the Federal Unsubsidized Direct Loan. Freshmen and sophomores may receive an additional $4,000 each year and juniors and seniors may receive an additional $5,000 each year. A parent must apply for the PLUS loan each academic year as it is a credit-based loan.

Financial Need

Financial need is the difference between the Cost of Education and the Expected Family Contribution. The Cost of Attendance consists of tuition, fees, books and supplies, transportation, and personal expenses. The Expected Family Contribution is the amount of family support the student (if dependent) and the student’s family (if dependent), is expected to contribute toward their student’s education.

Expected Family Contribution (EFC)

The Expected Family Contribution is determined by the U.S. Department of Education from the information submitted on the Free Application for Federal Student Aid (FAFSA).

Student Housing Status

A student’s application for financial aid will be based in part on his or her housing status because it is a factor in determining their cost of education. This information is taken from the Free Application for Federal Student Aid (FAFSA). There is a box at the end of the FAFSA where the student checks if they will be living “on campus,” “off campus” or “with parent.” For example, a student may be 35 years old but if he or she lives at home, the Cost of Attendance will be based on the “with parent” budget. Students may be required to submit a copy of their lease or deed to the Financial Aid Administrator.

Full-time vs. Half-time Enrollment Status

The amount of financial aid students receive also depends on their enrolment status. To be considered enrolled full-time for Federal financial aid purposes, students must be taking 12 credit hours per semester over at least 15 weeks. Students must be taking at least 6 credit hours per semester (half-time) to be considered for direct loans. Students may be taking less than 6 credit hours to be considered for Pell Grants.

How Grades Impact Your Financial Aid Eligibility

Students are required to maintain satisfactory academic progress each academic year to renew financial aid. The receipt of financial aid is a privilege that creates both rights and obligations. The United States Department of Education requires every post-secondary institution receiving federal funds (Title IV) to have an academic progress policy that is used to determine eligibility for and continued receipt of funds. To be eligible for financial aid, you must make satisfactory academic progress each year. Refer to Satisfactory Academic Progress Policy at our Important Financial Aid Policies page.

Applying for Financial Aid can be a very simple process, but must be done each year. Everything begins with the filing of the Free Application for Federal Student Aid (FAFSA). This can be done for the next financial aid year as early as October 1. Applicants should have the family’s income tax material available, so that information is accurate when completing the FAFSA.

Watch the video: Financial Aid Overview

Steps to File the FAFSA

- Dependent students and their parents must apply for a verified FSA ID from the U.S. Department of Education, https://studentaid.gov/fsa-id/create-account/. A FAFSA is not considered complete until both the parent and student have updated it with their FSA ID. Independent Students must apply for a verified FSA ID. This is considered the online signature form.

- Upon receiving a FSA ID, students complete the FAFSA online, https://studentaid.gov/h/apply-for-aid/fafsa and must include Studio Incamminati’s Federal Code 04232000

- When filing FAFSA on the web, students are encouraged to use the IRS DRT (Data Retrieval Tool), which allows the U.S. Department of Education to access tax year data directly from the IRS, rather than the student providing the data. This ensures the most accurate aid award and may satisfy the need for further tax information if selected for Federal Verification.

- After submitting the FAFSA, students receive notification from the Federal Government in the form of a Student Aid Report (SAR). The SAR contains the Expected Family Contribution and Pell Grant and Federal Direct Loans eligibility. Students must review carefully and correct any errors found.

An online tutorial is at www.finaid.ucsb.edu/fafsasimplification/

When Should Students File?

Students must file a FAFSA each academic aid year to be eligible for financial aid. We encourage new and returning students to file their FAFSA by Oct. 15. This new, earlier date allows students to get a head start on determining what type of aid they qualify for.

Who is Eligible to Submit a FAFSA?

- A student applying for, or already enrolled in, the Advanced Fine Art Program.

- And is a U.S citizen or eligible non-citizen.

- And has a valid Social Security card on file with the Social Security Administration

Dependent Student v. Independent Student

When applying for aid, it must be determined if students are dependent or independent status. The U.S. Department of Education has specific criteria that determine a student’s status. The FAFSA will ask a series of questions that helps determine status. For an Independent Student, one of the following criteria must be met:

- Be 24 years of age

- Be in a graduate program (beyond a bachelor’s degree)

- Be married

- Have children he or she supports

- Have legal dependents

- Be an orphan or ward of the court

- Be a veteran

- Be emancipated

- Be an unaccompanied youth who was homeless or at risk of being homeless

Dependent Students are claimed on the parent’s income taxes. Federal aid programs are based on the concept that a dependent student’s parents have the primary responsibility for their children’s education. If students do not meet the Independent Student criteria listed above, parent information is required.

Additional Tips

Students should pay special attention not to make errors when filing the FAFSA and verify all personal information, including the Social Security number and date of birth. Errors can cause delays in financial aid awards.

Students also should review the information that is sent back after filing the FAFSA on the Student Aid Report. Errors are indicated on the report. Corrections can be made by going back into the FAFSA at any time. The report may also indicate students have been selected for a Verification Audit Review.

NOTE: Federal Student Loans will not be disbursed to student’s account until he or she electronically completes both an Entrance Interview and signs the Master Promissory Note (MPN). Both of these can be completed by visiting www.studentloans.gov. A FSA ID and Social Security number are required to complete this process. The FSA ID is assigned when filing the FAFSA. The number can be retrieved by visiting https://fsaid.ed.gov/npas.

Important FAFSA Information

After submitting the FAFSA application to the Federal Processor (U.S. Dept. of Education), students will receive a Student Aid Report (SAR) in the mail (if applied by paper application) or by the WEB (if applied online). The SAR is a hard copy of the information provided on the FAFSA. This report tells the student’s Expected Family Contribution (EFC). It also gives the opportunity to correct any errors or update data. Students, who estimated their financial information when originally filed, must now use the SAR to correct data with accurate information. Students who are dependent must also have their parent sign the form. The third item students should review is the list of educational institutions that will receive financial information.

Important: Students must ensure that the Studio Incamminati code, number 04232000 is listed on the SAR.

Verification

Each year the U.S. Department of Education requires schools participating in the Title IV, Federal Student Aid programs to verify the consistency and accuracy of data submitted on the Free Application for Federal Student Aid (FAFSA). Any student who completes a FAFSA may be chosen for verification by the Department of Education. Nationwide, about 30% of all FAFSA applications are selected.

If selected, students (if independent) and their parents (if dependent) must supply documentation to confirm the data reported on the FAFSA form. Students must submit the verification worksheet and copies of their federal income tax transcripts or their parents. The Financial Aid Administrator notifies students regarding the necessary documentation that is required to satisfy the verification requirement. No federal financial aid may be credited to the student’s account until this process is completed.

“C” Flags

The U.S. Department of Education checks the FAFSA information with other federal agencies. “C” Flags indicate inconsistent information or information that could not be verified by the USDE system. All “C” flags are identified on the Student Aid Report (SAR) with an explanation on Part I of the SAR. All “C” flag issues must be resolved before the Financial Aid Administrator can disburse any financial aid. Resolution can occur through the assistance of certain federal agencies. You will be notified by the Financial Aid Administrator of the documentation or actions required to remove the “C” flags.

Selective Service

Men aged 18 through 25 are required to register with the Selective Service System in order to receive federal funding. Men who are between the ages of 18-25 and have not registered must register at www.sss.gov as soon as possible. Men over the age of 25 and have not registered for the Selective Service should contact the Financial Aid Administrator.

To process Federal Direct Loans, students need to complete a Master Promissory Note (MPN) and Loan Entrance Counseling. Students must follow the instructions below to complete the MPN and Entrance Counseling electronically.

- Go to https://studentaid.gov/fsa-id/sign-in/landing and sign in with your FSA ID (create one if needed). Students will need their social security number, personal information, employer information and school name.

- Student must complete the Master Promissory Note (MPN). Two references must be entered: one to be a parent or close relative, not living with the student and the other may be a friend.

- Students then e-sign the MPN.

Loan Entrance Counseling is required for first-time borrowers. Entrance counseling is a federal regulation mandated by the Department of Education which explains the student’s rights and responsibilities as a borrower.

New student borrowers will not receive credit for their Federal Direct Loan until both the Master Promissory Note AND Loan Entrance Counseling is completed. If students need assistance completing their MPN, they can contact the Direct Loan customer service center at 800-557-7397.

Please check out our Important Federal Student Aid Policies page.

Students who have borrowed federal direct loans are required to complete Exit Counseling upon completion of a program of study (graduation) or if they cease enrollment at Studio Incamminati (transfer out or withdrawal).

This requirement can be satisfied by visiting the National Student Loan Data System (NSLDS) website at https://studentaid.gov/exit-counseling/. Students need their social security number, date of birth, and FSA ID to log in.

Loan History

The National Student Loan Data System (NSLDS) is the U.S. Department of Education’s (ED’s) central database for student aid. NSLDS receives data from schools, guaranty agencies, the Direct Loan program, and other Department of ED programs. NSLDS Student Access provides a centralized, integrated view of Title IV loans and grants so that recipients of Title IV Aid can access and inquire about their Title IV loans and/or grant data.

Students can view their complete federal student loan history by visiting https://studentaid.gov. To log in to the system, students need to provide their social security number, date of birth and their FSA ID.

Federal Loan Consolidation

For information on federal loan consolidation, visit https://studentaid.gov/app/launchConsolidation.action

Studio Incamminati’s officers and employees may not receive directly or indirectly, points, premiums, payments, stock or other securities, prizes, travel, entertainment expenses, tuition payment or reimbursement, the provision of information technology equipment at below market value, additional financial aid funds or any other inducement from a guaranty agency or eligible lender in payment for securing applicants for loans.

The school or its employees may not provide names and addresses and/or e-mail addresses of students or prospective students or parents to eligible lenders or guaranty agencies for the purpose of conducting unsolicited mailings, by either postal or electronic means, of Title IV student loan applications.

Studio Incamminati will not allow any employee of the guaranty agency or eligible lender to perform any school-required function with the possible exception of exit counseling. The institution will not permit guaranty agencies to conduct fraudulent or misleading advertising concerning loan availability, terms or conditions.

Studio Incamminati will not permit employees to enter into a consulting arrangement or other contract with an eligible lender. In addition, the school will not permit an employee working in the student financial aid office to serve on an advisory board for an eligible lender.

Programs Info